Jmění Bitrow:

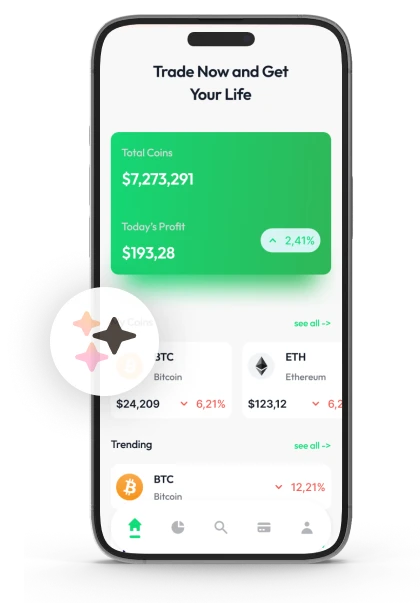

Jmění Bitrow: Shape Your Market Moves with Daily AI Analysis

Sign up now

Sign up now

Jmění Bitrow transforms complex digital market behavior into a clear navigational layer. It organizes fast moving activity, extended pauses, and irregular momentum into a readable flow, helping users stay oriented as conditions shift. Emphasis is placed on timing sensitive signals that adapt in pace, supporting measured evaluation without disrupting analytical balance.

Through ongoing learning applied directly to real time inputs, Jmění Bitrow identifies early structural alignment inside volatile conditions. This intelligence supports composure during unstable phases, delivering continuity as liquidity patterns and directional forces evolve.

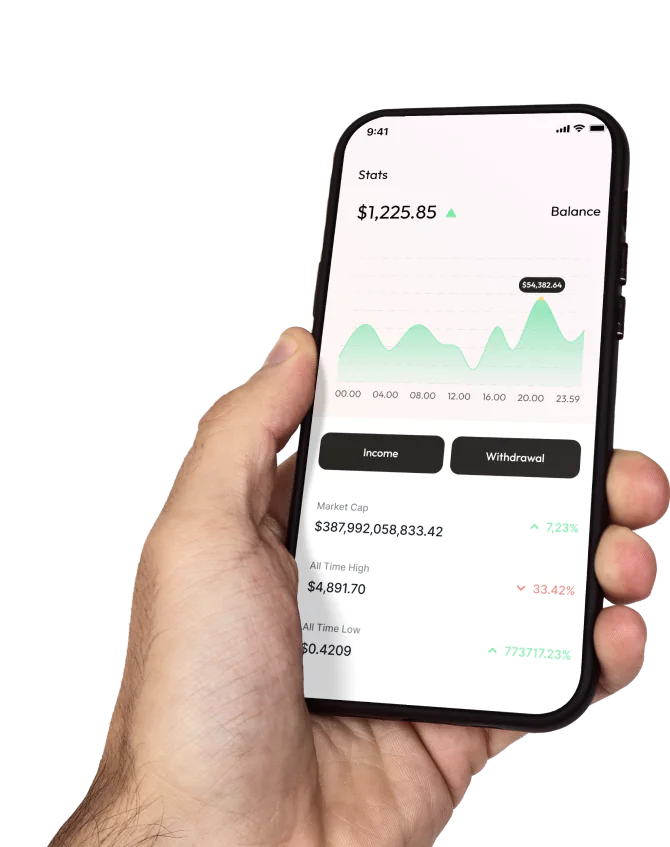

Its adaptive visualization system converts raw fluctuations into structured formations for easier interpretation. Jmění Bitrow functions solely as an analytical environment, remaining separate from execution venues. It delivers persistent monitoring, intuitive interaction, progressive intelligence models, and robust data security.

Within Jmění Bitrow, changing price behavior feeds into continuously adjusted analytical models that refresh instantly as new inputs arrive. Each signal undergoes controlled validation to reduce reaction noise and maintain disciplined response alignment. Historical sequences strengthen contextual learning, allowing every assessment to draw from accumulated analytical depth rather than isolated data points.

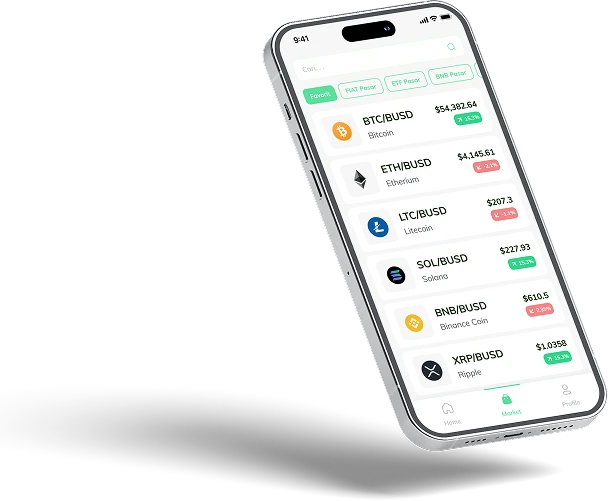

Jmění Bitrow continuously tracks crypto activity through responsive analytical layers. Market transitions are assessed for tempo and magnitude, reshaping volatility into usable context that supports strategic alignment and proportional decision making. Understanding deepens as momentum cycles rotate and sentiment driven dynamics redefine direction through disciplined interpretation.

Jmění Bitrow employs multi level logic to register immediate market responses and convert them into practical situational awareness. Continuous comparison between emerging formations and historical structures reveals early alignment changes. Focused guidance promotes stability, clarity, and adaptability during both reactive and transitional phases.

Jmění Bitrow enables users to align with proven strategic structures derived from aggregated learning models. Full decision control is retained, as adaptive indicators guide awareness without initiating transactions. Supervisory layers maintain analytical focus, while embedded intelligence evaluates wider market behavior and delivers time sensitive insights. The system operates independently, with no exchange linkage or trade execution.

Data integrity is foundational to Jmění Bitrow. Designed without exchange connectivity or execution capability, the system applies layered encryption, controlled access permissions, and continuous validation protocols. All information remains contained within a secured architecture built to uphold accuracy, confidentiality, and operational reliability.

Jmění Bitrow functions as an impartial analytical setting focused on awareness rather than outcome enforcement. Decision authority remains entirely with the participant, while advanced tools capture fine grained responses and emerging micro structures. Through precise monitoring, subtle shifts are identified, evaluated, and interpreted with consistency. Cryptocurrency markets are volatile, and losses are possible.

Within Jmění Bitrow, adaptive analytics engage live data streams as movement occurs. Each change is immediately contextualized to reflect current conditions. When anomalies or structural deviations arise, focused notifications enhance situational awareness, supporting disciplined observation during high activity and transitional market phases.

Within Jmění Bitrow, disciplined processing reduces reactive bias and promotes measured evaluation. Rather than responding to noise or speculation, layered assessment frameworks maintain analytical coherence. Advanced computation distills complex inputs, highlights meaningful movement, and establishes stable reference markers, supporting reliable operation through variable conditions. Contextual stability expands analytical depth, reinforcing consistency in strategic judgment.

Engineered with modular architecture, Jmění Bitrow adapts to shifting environments while enabling comparative reasoning across changing scenarios. Its internal systems align dynamic data streams with structured logic to reveal underlying behavior. Streamlined signal delivery minimizes disruption and preserves continuity, supporting focused interpretation through uncertain and fast changing phases.

By combining historical datasets with real time monitoring, Jmění Bitrow enhances recognition of recurring volatility patterns. Extended analysis surfaces repeat behaviors, sentiment oscillations, and structural tendencies across digital asset environments. This foundation enables live interpretation of responses to sudden movement, ranging from gradual acceleration to rapid directional change, across continuous exposure.

Operating without interruption, Jmění Bitrow maintains persistent situational awareness, identifying variable transitions as they occur. Automated intelligence evaluates volume activity in real time, isolating anomalies and emerging sentiment shifts. Identified signals prompt immediate contextual analysis, preserving alignment and interpretive stability across global cycles and rebalancing periods.

To sustain operational continuity, Jmění Bitrow provides structured assistance for resolving technical issues efficiently. Guided workflows convert challenges into traceable resolutions. A streamlined interface and adaptive controls support both developing and experienced analysts, ensuring smooth oversight, contextual updates, and uninterrupted interaction. The platform remains independent of exchanges and performs no trade execution, maintaining transparency and reinforced data protection.

Jmění Bitrow operates within a continuous monitoring framework that tracks momentum shifts, structural changes, and evolving narratives. High density data is distilled into focused insight precisely when relevance peaks. Adaptive intelligence evaluates pressure, uncovers concealed movement, and measures intensity, allowing participants to remain centered without responding to every short term fluctuation, even during heightened volatility, tightening liquidity, or broad market transitions where clarity is often obscured.

Functioning independently from exchanges and execution, Jmění Bitrow serves strictly as an analytical support system. Decision authority remains with the user, while the platform highlights inflection zones, strategic alignment points, and contextual timing windows across both subdued and accelerated conditions. Interpretation remains disciplined, reactions deliberate, and reasoning grounded in balanced assessment.

All internal activity within Jmění Bitrow is protected through encryption and layered verification protocols. The environment prioritizes structured clarity and efficient access, combining orderly design with responsive functionality. Adaptive tools, guided workflows, and stable system architecture promote confidence and composure even under demanding market conditions.

Sustained clarity is built through repetition and refinement. With structured matrices, segmented data streams, and continuous feedback loops, Jmění Bitrow maintains dependable evaluation across changing timeframes and broader outlooks. Historical records combined with adaptive visualization expose persistent behaviors while highlighting inefficiencies within current performance.

Real time detection within Jmění Bitrow identifies variable shifts as they occur. Targeted prompts support comparative assessment, progression review, and measured recalibration, allowing objectives to evolve while preserving flexibility as sentiment cycles and structural sequences reset.

Both short duration responsiveness and extended cycle positioning require discipline. Immediate conditions demand frequent reassessment, while longer horizons depend on contextual stability. Jmění Bitrow integrates these perspectives, delivering analytical reference points that allow participants to align approach with preferred duration and directional intent.

Momentum often forms within concentrated participation before becoming broadly apparent. By evaluating expansion, contraction, and rotational behavior, Jmění Bitrow identifies where strength is accumulating and where distribution is developing. This layered insight supports early recognition of directional shifts as leadership transitions across sectors and global environments.

Effective position oversight depends on defined parameters, timing controls, and measurable boundaries. Jmění Bitrow replaces assumption based reaction with scenario evaluation, structured checkpoints, and scheduled review cycles. Each adjustment is tied to contextual logic, supporting stability through periods of compression and acceleration.

Through regime classification and collective pattern analysis, Jmění Bitrow separates durable structure from temporary movement. It evaluates participation flow, correlation changes, and behavioral gradients that precede larger transitions. Timely alerts prompt reassessment, allowing benchmarks and reference sets to adjust efficiently. Each review documents rationale, refines standards, and reinforces disciplined awareness across active rotation phases.

Within Jmění Bitrow, specialized analytical tools translate digital activity into clear visual form. Range structures, momentum measures, and cycle based indicators illustrate movement speed, response zones, and directional pressure, strengthening contextual awareness and near term interpretation.

Threshold mapping highlights areas of compression and release, momentum analysis evaluates strength and progression, and oscillation tracking signals waning energy. Automated refinement layers improve accuracy by anchoring interpretation to verifiable measures rather than transient volatility.

By separating overlapping signals, Jmění Bitrow preserves the clarity of each structural view. Repeated evaluation, segmented validation, and organized feedback cycles sharpen timing and sequence recognition. This disciplined framework replaces uncertainty with measurable rhythm, sustaining reliability through continuous contextual alignment.

Market perception often shifts before measurable confirmation appears. Jmění Bitrow distills broad streams of social conversation, commentary, and reporting into focused sentiment insight, filtering noise to surface the most influential drivers.

Its scanning engine processes large scale information flows to detect meaningful emotional changes at an early stage. Rising optimism may reflect building momentum, while fading conviction can signal diminishing strength across liquidity cycles, session overlap, and transitional phases where sentiment leads reaction.

This layer of interpretation works alongside structural analysis. By monitoring behavioral tone through Jmění Bitrow, strategies remain aligned with prevailing market psychology. Source comparison, equilibrium detection, and narrative refinement transform public expression into actionable context, supporting steadiness and clarity during variable conditions.

Significant macro developments, such as fiscal policy changes, interest rate shifts, or labor data releases, can materially alter crypto market direction. Through AI driven macro analysis, Jmění Bitrow evaluates how these external forces reshape asset alignment, particularly during periods of policy tightening that redirect attention toward decentralized exposure, institutional rebalancing, and divergent sentiment across global markets.

Policy driven change tends to unfold over extended horizons. By connecting historical progression with real time momentum, Jmění Bitrow produces forward looking analytical frameworks that support composure through volatility, directional reversals, and prolonged uncertainty within expanding digital ecosystems.

Market behavior often unfolds through subtle timing changes. Jmění Bitrow integrates long range analysis with real time evaluation to align asset movement with technical structure. This approach creates defined analytical windows for detailed study, configuration, and disciplined planning across shifting liquidity and variable environments.

Using its adaptive architecture, Jmění Bitrow detects recurring rhythm patterns, structural cycles, and phase transitions. These insights reveal timing relationships that clarify how sequential flow influences performance through volatility, reversals, and complex conditions where perspective supports stability and measured advancement.

Rather than relying on isolated exposure, diversified layering distributes participation to reduce dependency on single events. Through AI driven correlation analysis, Jmění Bitrow models portfolio behavior under stress, identifying convergence and divergence relationships as pressure increases across simulated scenarios.

By reducing analytical distortion, Jmění Bitrow highlights developing directional bias before expansion becomes apparent. Acceleration bursts, compression zones, and early stress signals are identified ahead of broader visibility, enabling preparation and structured response instead of reactive momentum pursuit.

Significant movement often develops beneath quiet conditions. Through focused evaluation, Jmění Bitrow distinguishes genuine accumulation from background fluctuation, maintaining attention on validated pressure dynamics rather than misleading surface motion.

With AI assisted diagnostics, Jmění Bitrow interprets rapid expansion, concealed pullbacks, and irregular spikes with contextual depth. Apparent randomness is reorganized into structured indicators, converting uncertainty into readable rhythm and informed observation.

Jmění Bitrow combines high speed data interpretation with disciplined analytical architecture to maintain clarity during volatile conditions. Incoming information is organized, evaluated, and refined into actionable context that reveals changes in momentum, recurring cycles, and core equilibrium zones.

Responsive to participant calibration, Jmění Bitrow adapts as conditions evolve. Each update incorporates live variability while preserving analytical structure, depth, and logical consistency, providing stable reference points and controlled orientation through periods of instability.

Jmění Bitrow uses advanced learning systems to organize large volumes of data into clear analytical layers. By detecting fine behavioral signals hidden within noise, the platform isolates what matters before information becomes overwhelming. This process reshapes complexity into structured insight, allowing analysis to remain precise, readable, and logically segmented.

Jmění Bitrow is designed to support both newcomers and experienced analysts. Its adaptive interface reduces the friction often associated with complex research tools, transforming intricate market cycles into balanced, accessible views. Every component is structured to promote clarity, orientation, and sustained understanding at any experience level.

Jmění Bitrow functions independently of exchanges and does not execute trades. This separation preserves neutrality and transparency. Each analytical layer is built to reveal context rather than dictate outcomes, ensuring focus remains on disciplined interpretation and informed awareness across changing market conditions.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |